Former AKP deputy criticizes sweeping tax reform

Turkey is poised to introduce its most comprehensive tax reform in two decades, a move that has sparked internal criticism within the ruling Justice and Development (AKP) party.

The reform, set to be presented to the parliament after the Eid al-Adha holiday, comes as the country grapples with economic challenges and the implementation of austerity measures by Finance Minister Mehmet Şimşek.

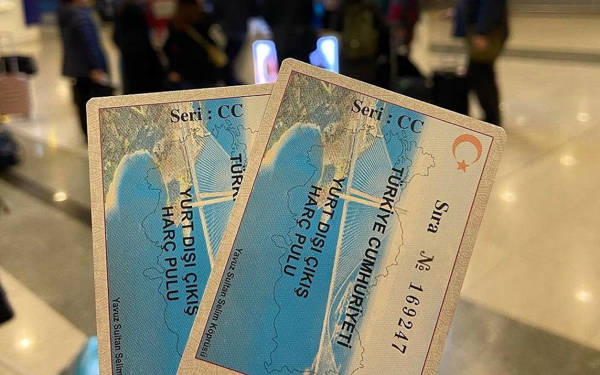

The proposed tax package includes increases in taxes and fees, along with the introduction of new taxes. It is part of a broader austerity plan aimed at curbing inflation, which has soared to nearly 70% year-on-year. The plan also involves cost-cutting measures across the public sector, including a ban on purchasing new vehicles for civil servants and a reduction in public spending by 100 billion liras (~3.1 billion US dollars).

Şamil Tayyar, a former AKP deputy and a prominent figure within the party, has voiced concerns that the new tax system's stringent regulations could exacerbate public unrest, which has been rising due to the cost of living and deepening poverty.

"This tax reform, presented as 'tax justice' by the economic management, almost taxes the air we breathe," Tayyar said on social media, warning of the potential political complications.

“If this tax package shaped by the economic bureaucracy is not reformed in parliament, it will likely exacerbate social unrest due to the rising cost of living and deepening poverty.

“The political implications of this are evident. It seems the economic bureaucracy is haphazardly cutting and trading at the desk, manipulating the balance sheets and numbers. The focus of these decisions is on 'statistical' rather than 'humanitarian' data.

“If this reckless approach is due to the belief that there is ample time before the election, let this be a warning: even ten years would not be enough to correct this course.”

Tax justice in Turkey

The tax system in Turkey relies heavily on indirect taxes, with direct and income taxes contributing a relatively low proportion compared to indirect taxes. The country’s tax structure is characterized by a higher reliance on indirect taxes such as value-added taxes (VAT) and goods & services taxes, compared to direct taxes like personal and corporate income taxes.

This has been a point of discussion, as indirect taxes tend to be more regressive, affecting lower-income individuals disproportionately. The tax-to-GDP ratio in Turkey decreased from 22.8% in 2021 to 20.8% in 2022, which is significantly lower than the OECD average of 34.0%. (HA/VK)